Bookkeeping basics: A guide for small businesses

For example, when money comes from a sale, it will credit the sales revenue account. Making sure transactions are properly assigned to accounts gives you the best view of your business and helps you extract the most helpful reports from your bookkeeping software. Our bookkeepers here at Bench bookkeeping services in sacramento can do your books for you entirely online. We’ll also give you easy-to-use software to produce financial statements, keep track of your daily expenses, and help make tax time a breeze. Try setting aside and scheduling a ‘bookkeeping day’ once a month to stay on top of your financials.

Small Business Bookkeeping (2024 Guide)

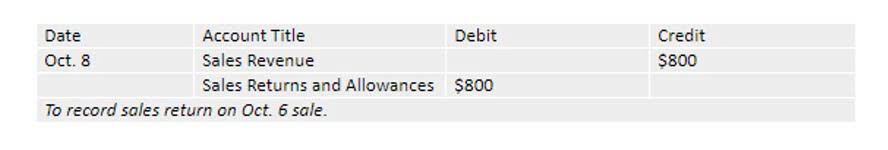

Bookkeeping was once done manually using actual books called journals and ledgers. Because bookkeeping is based on double-entry accounting, each transaction affects two accounts — one gets debited and the other is credited. Bookkeeping is broadly defined as the recording of financial transactions for a business.

Transitioning from bookkeeping to accounting roles

- It could result in improving processes or making purchasing decisions.

- For example, your bookkeeper will need to make sure that every transaction in your business’s financial records has an entry.

- It’s an easy-to-use solution that makes it quick and simple to manage employees’ hours.

- Keeping up with the records in your small business might be a task you are willing and able to tackle yourself.

- As a small business owner, she is passionate about supporting other entrepreneurs and sharing information that will help them thrive.

- Expenses are all the money that is spent to run the company that is not specifically related to a product or service sold.

You record transactions as you pay bills and make deposits into your company account. It only works if your company is relatively small with a low volume of transactions. Bookkeeping is the process of keeping track of every financial transaction made by a business—from the opening of the firm to the closing of the firm. Depending on the type of accounting system used by the business, each financial transaction is recorded based on supporting documentation.

Tackling the talent issue: Xero report examines accounting and bookkeeping industry’s ‘image problem’

At the end of every pay period, the bookkeeper will accumulate employee payroll details that include hours worked and rates. From there, the total pay is determined with the applicable taxes and withholdings. In the accounting software, the primary journal entry for total payroll is a debit to the compensation account and credits cash. Bookkeeping is the process of tracking income and expenses in your business. It lets you know how you’re doing with cash flow and how your business is doing overall. Staying on top of your bookkeeping is important so that you don’t have unexpected realizations about account balances and expenses.

Without bookkeepers, companies would not be aware of their current financial position, as well as the transactions that occur within the company. Their work plays an important role in the operation of a successful business, which can have very many transactions in a single day, let alone a week, month, fiscal quarter, or year. Petty cash is a small amount of money that your business uses for different purposes throughout the day. This could be as simple as buying doughnuts for your office or grabbing lunch during an impromptu meeting. To keep track of these expenses, you’ll need to use the petty cash bookkeeping method. Whether you’re trying to determine the best accounting system for your business, learning how to read a cash flow statement, or creating a chart of accounts, QuickBooks can put you on the right path.

What is the approximate value of your cash savings and other investments?